The new windows tax deduction can be a huge help for many people, but what does it even mean? What are the benefits of it? In this article, discover all you need to know about the newly introduced tax deduction and how it might benefit you in your own life.

What is the New Windows Tax Dedification Act?

The New Windows Tax Deduction Act was signed into law on October 17, 2017. This new act will allow individuals and businesses to deduct the cost of qualifying Windows software from their income taxes. The deduction is applicable to both personal and business use of Windows software.

The following are some key points to keep in mind about the new Windows tax deduction:

The deduction is available for the purchase, installation, or subscription of qualifying Windows software.

Qualifying Windows software must be used for business purposes. This means that the software must be used in order to generate income or improve an organization’s performance.

The deduction is limited to a maximum amount of $250 per individual or $500 per business.

In order to qualify for the deduction, you must provide documentation supporting your claim. This documentation includes your purchase receipt, invoice, or other proof of purchase.

How does it Affect the Average American?

The new Windows 10 tax deduction is a big deal for millions of Americans. Here’s everything you need to know about it. filemytaxesonline.org

First, let’s get one thing straight: the new Windows 10 tax deduction only applies to people who own or lease a computer that runs Windows 10. That means it won’t help you if you’re using an older version of Windows, like Windows 8.1 orWindows 7.

Second, the new Windows 10 tax deduction is available only on computers that are used exclusively for personal purposes. That means you can’t use it to offset the cost of a desktop computer, laptop, tablet, or other device that you use in your business or professional life.

Finally, the new Windows 10 tax deduction is worth up to $1,250 per individual and $2,500 per married couple filing jointly. So if you have three qualifying devices in your home, each with a $1,250 value, you’ll be able to deduct up to $3,750 from your taxes this year.

When Does It Take Effect?

The new Windows 10 tax deduction goes into effect for the 2018 tax season. Here’s what you need to know about it:

1. You can take the deduction if your adjusted gross income is below $157,500.

2. You can’t take the deduction if your filing status is married filing separately or if you’re a head of household.

3. The deduction is available only on desktop and laptop computers.

4. You can deduct up to $2,000 per computer in 2018, up from $1,250 in 2017.

5. If you sell or give away your computer within three years of buying it, you have to subtract the full cost of the computer from your total deduction.

6. You have to keep track of which year’s taxes you’re deductible in order to get the most benefit from the new Windows 10 tax deduction

Who Qualifies for this Deduction?

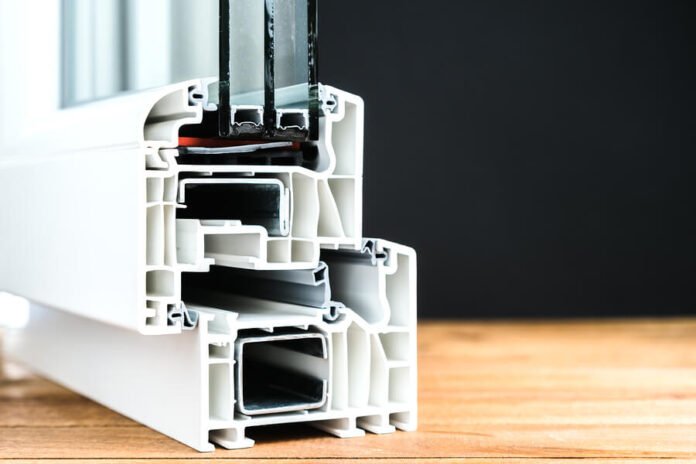

If you itemize your deductions on your federal income taxes, you are able to claim a deduction for the cost of qualifying windows. You can deduct the full cost of qualifying windows, including materials and installation costs. The IRS has created a list of qualifying windows that are included in this deduction. This list is updated annually and can be found at irs.gov/windows/qualifying-windows.

You must meet all of the following requirements in order to qualify for this deduction:

Your windows must be installed on your main residence or an attached structure used primarily for residential purposes.

The windows must be installed in order to improve energy efficiency.

The windows must be installed after December 31, 2007.

Conclusion

It’s that time of year again – taxes! If you’re like most people, you probably have a lot of questions about the new Windows 10 tax deduction. This article will answer some of the most common questions about the Windows 10 tax deduction and help you understand what it is and how it works. Hopefully, this will help simplify your tax preparation process this year.