Availing financial assistance from reputed lenders always comes with a price. This borrowing cost is indicated in percentage and termed as the interest rate. It is a crucial factor for borrowers as well as investors. Interest rate is of two sub-types, depending on the calculation method- compound interest and simple interest.

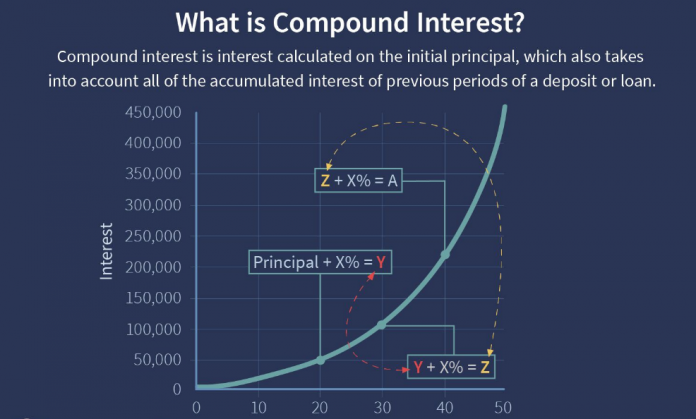

Among these two, compound interest defines as an interest calculated on initial principal sum and collective interest from previous periods. Investors appreciate this type of interest rate as it impacts their earnings through investments. Hence, individuals planning to invest must know certain crucial things about compound interest to maximise its benefits.

A Quick Guide on Compound Interest

Knowing compound interest is a significant factor when structuring your wealth. As already stated, it is the interest levied on a deposit or loan that is estimated based on the initial principal sum and the accumulated interest amount. It is an effective way to produce substantial income in investment and financing.

The total number of compounding periods makes a remarkable difference when evaluating compound interest. If the compounding periods are higher, the interest rates will be higher. On the contrary, simple interest evaluates the total amount a borrower has to pay as an interest component over a particular period on a certain principal amount.

Compound interest can be a bit complicated compared to simple interest. However, individuals conveniently calculate this rate using the compound interest rate formula.

A = P (1 + [r/n) ^nt

Here, P refers to the initial deposit, which is the principal, A refers to the compound interest, r denotes a rate of interest, t refers to a period in years, and n is the number of times the interest is compounded over a given period.

For instance, if an individual invests Rs. 1,00,000 at 10% annual interest rate for five years compounded in half-yearly period, the accumulated interest would be-

A = 1,00,000 x (1+10% / 2) ^ (5 x 2) – 1

= Rs.1,62,889

So, the compound interest will be Rs. 62,889.

However, if a borrower obtains a personal loan of Rs.10, 0000 at 12% for five years, the simple interest would be –

A = P (1+RT)

Therefore, the interest amount will be Rs. 33,478

Advantages of Compound Interest

Here are some remarkable benefits of using compound interest for calculation:

- Higher growth

The concept of compound interest is a simple yet accurate explanation of interest. It denotes that the income generated from the investment is added to combine the earnings. Therefore, this interest calculation method ensures better growth over a similar period compared to compound interest.

- Prospective growth in the long run

Compound interest provides a considerable return, and the above pointer emphasises this statement. In addition, the following interest produced from the initial investment gets compounded every time, thereby offering higher returns.

- Role of compounding frequency

The compounding frequency significantly impacts the income produced through this interest calculation method. A higher frequency can yield considerable returns multiple times and vice versa. Moreover, the frequency of compound interest can be yearly, quarterly or half-yearly.

Thus, being aware of the advantages of compound interest will allow borrowers to act accordingly.

Which type of interest is calculated while evaluating EMIs?

The financial sector revolves around interest rates. However, if individuals want to determine how EMIs are calculated, they will find out that none of these calculation methods is used. Therefore, while planning to apply for a personal loan, individuals must know that lenders follow a reducing balance procedure to evaluate EMIs.

The mathematical formula of calculating EMIs with this method is –

EMI = [P x R x (1+R) ^ N] / [ {(1+R) ^ N -1]

Here, P refers to the principal amount, R is the interest rate, and N signifies tenor.

Prospective borrowers can use this formula to evaluate EMIs. However, calculating the EMIs manually can be a difficult task. Hence, one can use a personal loan calculator to find the desired results without any interruption. Additionally, this online instrument provides a detailed EMI breakup of the outstanding payable loan, comprising interest and a principal component.

Here, borrowers need to keep in mind that failing to pay EMIs can lead to paying penalty charges. Moreover, it can negatively impact a borrower’s credit profile. Hence, individuals must know about the mistakes to avoid when it comes to repaying a debt. Along with this, individuals must not forget to check the loan terms and additional charges.

Intending borrowers can also seek lenders that streamline the loan application process and reduce the hassle of extensive documentation. In this regard, they can resort to pre-approved offers extended by leading financiers like Bajaj Finserv. These offers are available on a wide range of financing options, such as personal loans, business loans, credit cards, etc. You can check your pre-approved offer by mentioning your name and contact details.

Both compound interest and simple interest have no significant role in evaluating loan calculation. Nonetheless, being aware of them is essential as it will allow borrowers to get a fair idea about the return from investments.